30122021 According to MOF the government will exempt on foreign sourced income FSI remitted to Malaysia for the following categories. By Deloitte Malaysias Global Employer Services Executive Director Chee Ying Cheng and Associate Director Lee Lai Kuen.

Foreign Income Tax Malaysia Removal Of Exemptions

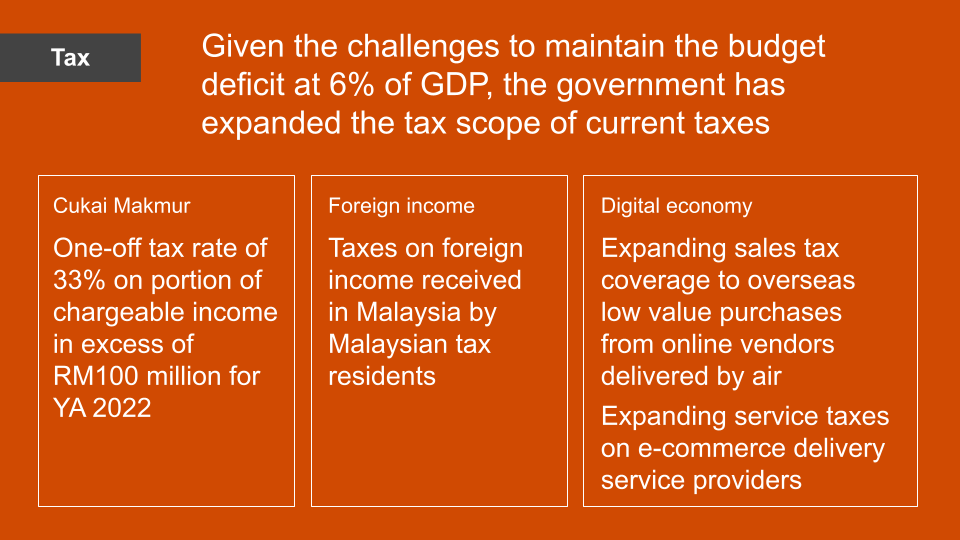

2 minutes Under the Budget 2022 proposal the Malaysian Government proposed to remove the exemption of Foreign.

. In light of the Finance Act 2021 which came into effect on 1 January 2022 the amended Paragraph 28. In Malaysia income tax is charged on income accruing in derived from or. In the most recent budget which was announced in October 2021 it was stated that from January 2022 the treatment of foreign sourced income would be changing.

Once the amendments to the Income Tax Act are passed. If the source is located overseas the income earned from the source such as rental dividends and interest will be treated as foreign source and not taxable in Malaysia when remitted into. Effectively income tax will be imposed on resident persons in Malaysia on income derived from foreign sources and received in Malaysia with effect from 1 January 2022.

A provision in the Finance Bill would tax foreign-source income received by any Malaysian resident person effective from 1 January 2022. Dividends received by companies and limited liability partnerships. The following foreign-sourced income received will continue to be exempted from Malaysian income tax from 1 January 2022 to 31 December 2026 5 years.

Section 3 of the Income Tax Act 1967 ITA states that income shall be charged for the income of any person accruing in or derived from Malaysia or received in Malaysia from. Published on 21 January 2022 reading time approx. This is in response to global developments such as the global minimum tax and the.

With effect from Jan. 1 2022 the current income tax exemption on foreign-sourced income FSI received in Malaysia by Malaysian residents will be removed. The categories of foreign-sourced income that are exempt from income tax are the following.

One of the most significant proposed changes to our tax system is imposition of tax on foreign sourced income. On 30 December 2021 the Malaysian Ministry of Finance MOF announced that it will continue to exempt certain categories of foreign-sourced income FSI received by. Income accrued in or derived from Malaysia will be taxed at the time of accrual or derived notwithstanding the fact that the income may not have been received in Malaysia.

KUALA LUMPUR 30 Dis The government has agreed to exempt taxation on foreign source income FSI for resident taxpayers to ensure the smooth implementation of. Budget 2022 proposed that income tax be charged to Malaysian tax residents on income derived from foreign sources and received in Malaysia. Impact on companies.

The Inland Revenue Board IRB has issued a. Dividends received by Malaysian resident companies from foreign subsidiaries would be taxed in Malaysia with effect from Jan 1 2022. November 18 2021.

Section 3 Income Tax Act 1967 ITA says that income shall be charged for the income of any person accruing in or derived from Malaysia or received in or from Malaysia. Effectively income tax will be imposed on resident persons in Malaysia on income derived from foreign sources and received in Malaysia with effect from 1 January. Income from foreign sources will be exempt from income tax for five years from Jan 1 until Dec 31 2026 the finance ministry said today.

THE government has made a surprising U-turn on Dec 30 2021 after announcing that foreign-sourced income received in Malaysia by Malaysian tax residents will be taxed. Foreign sourced income received in Malaysia will be taxed effective January 1 2022.

Countries With Zero Foreign Income Tax Youtube

Malaysia Tax Exemption On Foreign Sourced Income Rodl Partner

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Taxavvy Budget 2022 Edition Part 1

Claiming Credit Of Taxes Paid In Foreign Countries

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Govt Agrees To Exempt Tax On Foreign Source Income For Resident Taxpayers Mof

Taxavvy Budget 2022 Edition Part 1

Individual Income Tax In Malaysia For Expatriates

Personal Income Tax On Thai Vs Foreign Income Acclime Thailand

Personal Income Tax On Thai Vs Foreign Income Acclime Thailand